What is Community Investing?

Banks play an essential role in our economy by lending money to people and businesses. When people have access to a mortgage, a small business loan, or workforce training, it spurs economic growth. The issue is that not everyone - such as people with low income, minimal assets, or limited credit histories - have access to these products and services that many of us consider to be basic. While government funding and grants attempt to fill this gap, there is not enough funding to go around.

Community investments allow private investors to direct capital into areas where there is a need. Community investments can catalyze change in the form of economic growth, development, and revitalization while providing the investor with a rate of return. Investments may include affordable housing, health centers that serve low-income citizens, or flexible mortgages for those who otherwise wouldn't qualify.

How do investors participate in community investing?

CNote

CNote is an investment platform that allows you to invest your money in a portfolio of Community Development Financial Institutions (CDFIs). CDFIs are certified by the U.S. Department of the Treasury and are required to provide access to financial products and services in distressed communities. CNote is currently paying investors 2.75% and offers quarterly liquidity. CNote tracks their impact, including the number of jobs created, loans funded, and the percentage of capital deployed to women and minorities. To date, this fund has invested $18M and 100% of the investors have had their money paid back on time, with interest.

Calvert Community Investment Note

The Calvert Community Investment Note invests in a broad spectrum of community development, affordable housing, micro-finance, and small businesses. The note is paying rates ranging from 1.5% to 4.0% depending on the maturity. Here is a list of Calvert’s projects that you can view by impact type or geography. You can invest in some of the holdings directly but you will likely be required to invest a higher minimum (versus a minimum of $20 for this note) and your holding will be more concentrated. Calvert tracks their impact including the number of loans issued. To date, this fund has invested $2B and 100% of the investors had their money paid back on time, with interest.

Enterprise Community Loan Fund

Enterprise is a CDFI that has an impact note called the Enterprise Community Loan Fund (ECLB). The note is paying rates ranging from 1.0% to 3.5% depending on the maturity. You can see a list of projects the ECLB is actively invested in. To date, this fund has invested $1.7B and 100% of the investors had their money paid back on time, with interest. Note, this fund is one of the investments included in the Calvert Community Investment Note listed above. Enterprise tracks their impact including the number of homes preserved.

How does the return of CDFIs compare to traditional investments?

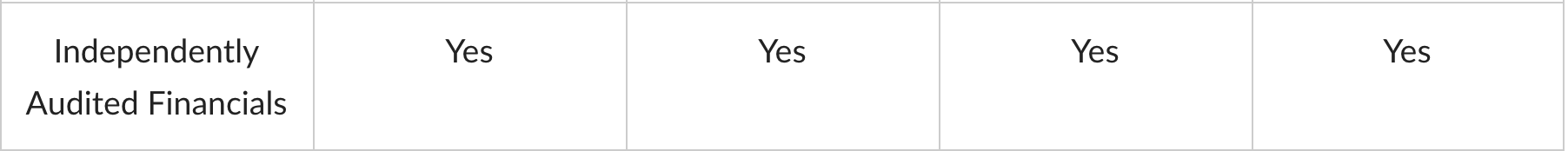

Here is a summary of the above 3 community investments compared to a traditional CD. Note: The investments listed in this post are not recommendations but provided for informational use only.

What is the risk associated with community investments?

All investments are subject to risk and past performance is not indicative of future results. While that can be said about any investment, community investments have unique risks.

CDFIs are lending to a part of the population that traditional banks may consider too risky. CDFIs had higher delinquency rates (5.29% vs. 3.53% during 2001-2015) than traditional banks, but lower net charge-off rates (0.65% vs. 1.05%). A likely explanation is that CDFIs are more mission-driven and lenient in terms of accommodating late payments and working with the borrower. Regardless, charge-offs will occur and for that reason, banks, CDFIs, and the investments listed above are required to have layers of protection, such as a loss reserve.

Community investments are typically smaller than traditional banks and may be less resilient when there are operational changes. For example, if there is a change in key leadership, that may affect the performance of the community investment.

Community investments may also receive grants from foundations and other organizations that help to fund their operations. If those funding sources disappear, that will affect investors.

I am new to impact investing and interested in community investments. How do I get started?

The investments listed in this post are not recommendations but provided for informational use only. If you are interested in learning more about community investments, contact your PWR Advisor to understand if and how to best integrate them into your specific portfolio.

Direct the impact of your investment portfolio.

Impact investments seek to generate a positive environmental and social return in addition to a financial return. Help fund your community's transition to a more sustainable and equitable future. We can help.

Linda Rogers, CFP®, EA, MSBA is the owner and founder of Planning Within Reach, LLC (PWR). Originally from New Jersey, Linda services clients throughout San Diego county and nationwide. She leads the design of PWR's investment portfolios which utilize broad, low-cost investments that integrate environmentally, socially, and governance (ESG) factors.

Planning Within Reach, LLC (PWR) is a fee-only and fiduciary wealth management firm offering one-time comprehensive financial planning, ongoing impact-focused investment management and tax preparation services in San Diego and nationwide. PWR is a woman-owned firm that specializes in busy professionals and impact investors. Planning Within Reach, LLC and their advisors do not receive commissions and do not hold any insurance licenses or brokerage relationships.